For as long as banks have been around, the bank ledger has been the principal record for storing account information, balances, and transactions. How much money do you have in your bank account? That’s in the ledger. Got your paycheck today? Recorded in the ledger. Paid your rent? That’s also captured in the ledger.

Modern-day banks and credit unions have moved beyond paper ledger books to technology-enabled solutions, many of which typically reside on mainframe systems procured from third parties. Today, a new world of players are building modern, flexible ledger systems loosely coupled with traditional banking core systems. These Banking-as-a-Service (BaaS) providers are tackling age-old banking concepts like:

- Transaction posting

- Pending and settled balances

- Funds availability and reconciliation

Key components of the ledger

Starting with ‘first principles’ here are the fundamental components of what makes up a ledger (as has been the case for thousands of years!), and how they can be improved upon:

Accounts

Traditional banking core systems are bound by strict structures of what a checking account is versus a savings account or versus a loan account. These accounts all come with a cost and are difficult to change. With modern technology, BaaS platforms can offer free, flexible [virtual] accounts that blur the lines between what an account is and isn’t. Indeed, with leading fintech apps like Dave, Stash, or Acorns, it seems more like you’re joining their app and the ecosystem they provide rather than opening a distinct bank account.

Balances

Perhaps no string of numbers is more important in our lives than the digits recorded in our bank balance. No number can bring as much anxiety or provoke regular questions like “How much can I spend?” or “How much do I owe?”. You would assume the calculation of a balance would be simple math. However, the deeper you get into the legacy banking system and payment networks that facilitate transactions, the more you realize how challenging it is to provide an accurate balance number. Check your account at a traditional bank and you’re likely to see two or three balances shown with names like Ledger Balance, Current Balance, or Available Balance. How is a user (unfamiliar with arcane banking terminology) supposed to know how much money they have? At Productfy we return Available Balance [and recommend partners display it] as the one and only balance users should care about as it provides a true reflection of the amount of spending power they have at a given moment.

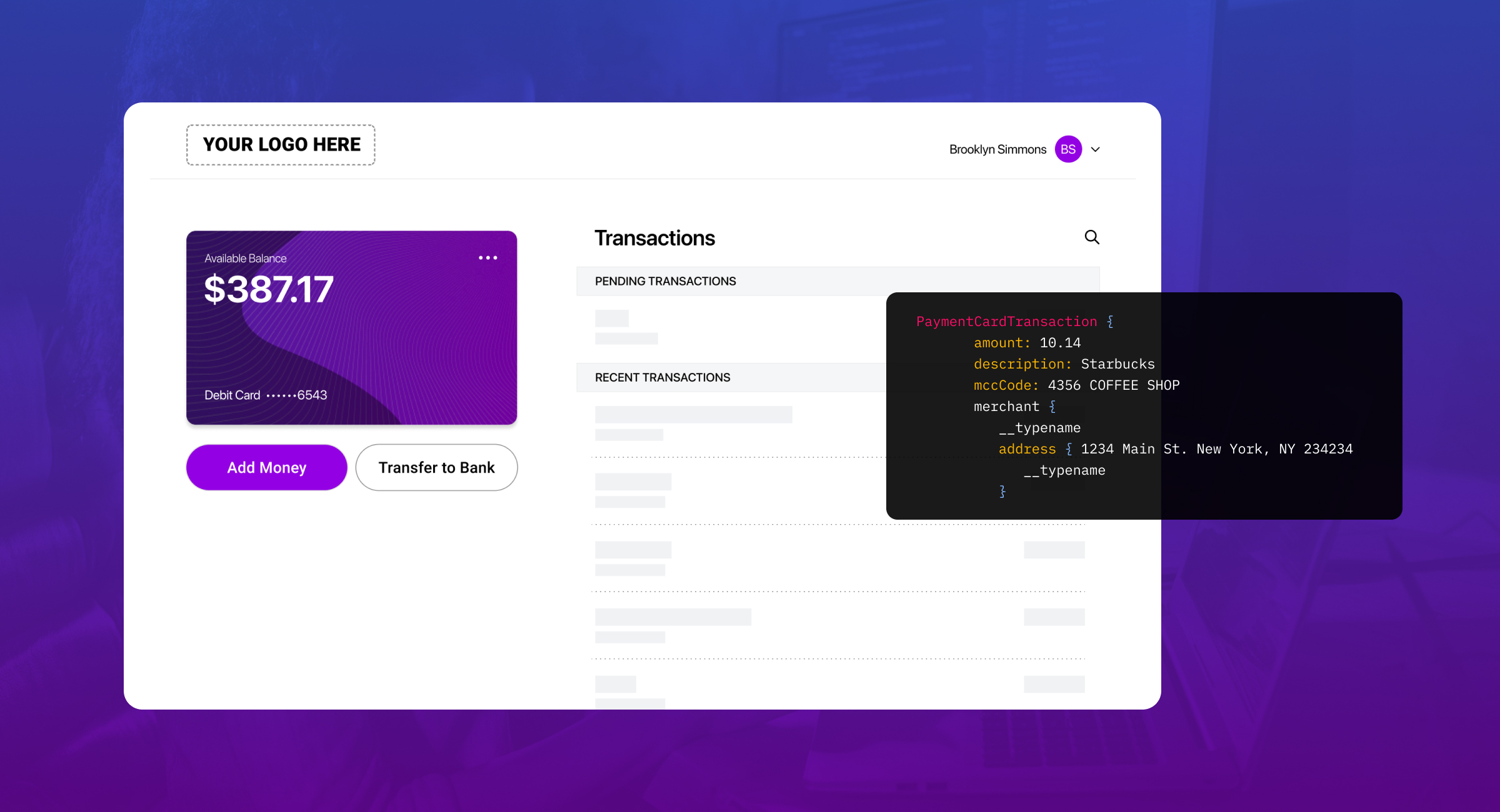

Transactions

We expect a Google search to return an accurate list of results in a fraction of a second. We also expect nothing less of our bank and/or fintech app to provide an accurate and comprehensible list of precisely what happened in our account. Again, the dependency on payment networks like Automated Clearing House (ACH) or Visa or Mastercard makes it much more difficult than you would imagine to simply display a complete transaction history. Take a close look at your bank statement and you may see entries like:

SIGNATURE POS DEBIT 09/02 MD BALTIMORE GIANT FOOD INC SEQ# 071582

DEVONSHIRE II CO CONS CP BC5198

At Productfy our ledger is coded to store clear values for merchant name and location so transactions don’t end up looking this way. Here’s an example of how a typical transaction would be posted in Productfy’s Latinum interface:

Key Differentiators Of Modern Ledgers

Single System

A traditional bank infrastructure involves multiple disparate third-party systems that run deposits, loans, and credit cards separately. In other words, multiple ledgers that all look and work differently – and don’t talk to each other. Productfy, a modern BaaS company, has built a virtual ledger from the ground up to be one simple, flexible system that acts as the ledger for any type of account. The same set of APIs are used for whichever account type, with all transactions stored in a common data structure.

API-enabled from the start

Productfy’s virtual ledger is accompanied by a full suite of APIs that allow countless ways to query and change data. Need to pull a year’s worth of transaction data in a paginated format on an account? We have an API for that. Need a single API to pull any piece of user data? We have an API for that.

Real-time from the start

Traditional banking systems are entrenched in end-of-day batch processing schedules that are carryovers from a more branch-based and paper check-centric world. Routine processing delays can result in user confusion on why their account balances haven’t been updated, or why they aren’t seeing a transaction they believe should have already completed. With modern BaaS technology, periodic batch processing is no longer required, as transactions are recorded as soon as they happen – in real-time.

Card Transaction Data-enabled from the start

More data is typically better than less data. Payment card transactions contain a ‘good’ amount of data. However many banking systems don’t store or expose this data. Productfy’s BaaS platform provides real-time card transaction data via API or a webhook. This allows customer-friendly features to be enabled like real-time push notifications when a transaction is declined (including the reason for the decline).

Cost-Effective

Legacy technology vendors will often charge banks a fee for each account stored on the system. There are two concerns with this:

- The additional account doesn’t cost the technology provider anything but a few extra bytes of data storage – fractions of a penny at best.

- The fee creates an additional cost and disincentive for a bank to create more accounts.

With a modern technology stack like Productfy’s BaaS platform, you can create an unlimited number of accounts at no extra cost. This opens the door to innovative use cases like allowing users to create their own sub-accounts for savings goals, or even creating accounts that store balances from outside the Productfy platform.

Where does this lead us?

Right now, the banking infrastructure is being rewritten daily. And the definition of what it means to be a “bank” has radically changed forever. Thanks to the latest innovations in fintech, it’s easier than ever to launch financial products and applications – and quickly reach an untapped or underserved marketplace.

Productfy accelerates financial product innovation. We do that by leveling the playing field, giving you a turnkey virtual ledger, built-in compliance, developer-friendly APIs, white-label solutions, and rigorous developer documentation.

In a coming soon post, we will talk about how our ledger powers a globally-distributed financial infrastructure, to enable DeFi on traditional banking rails.

Schedule a demo today to learn more – and see just how Productfy makes it possible to go from fintech concept to launch in a little as three weeks.