September was a month of growth for us - both as a company by onboarding new employees and as a platform by seeing usage increase through our clients scaling. We hope our feature releases in the month help to continue this virtuous cycle. Here are the highlights:

Credit Profile API

Productfy now offers a simple API to access credit bureau information from Equifax. This is helpful in underwriting loan products or making risk decisions on credit card applicants. The advantage of using this service via a BaaS platform like Productfy is that it is highly integrated into the rest of the platform, to let you easily create an end-to-end experience around it. See API documentation here.

There are 4 features available as part of the Credit Profile API:

- Full Credit Report: a hard pull on your credit report returning the full data set

- Pre-qual: a soft pull on your credit report returning a subset of data to pre-qualify loan applicants

- FICO Score: the main credit score used in credit underwriting

- Vantage Score: an alternative to the FICO score, using data from the 3 main credit bureaus

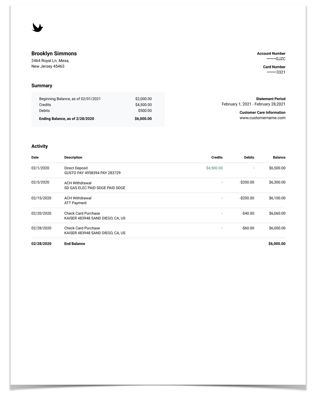

e-Statements

We now offer branded, PDF e-statement generation on accounts and cards. Our system does all the heavy lifting of establishing statement cycles, compiling data and producing compliant PDF statements. Our API allows you to retrieve all available statements and a single PDF statement. See API documentation here.

Real-time Debit Card Transaction Data

There is a treasure trove of data in payment card transactions that can be used for innovative rewards systems, enhanced transaction display and improved risk management. We are now capturing more data fields and exposing it in our PaymentCardTransaction data object. This includes fields like:

- Interchange amount

- Merchant address, city, state, ZIP

- Recurring payment indicator

- Network

Watch this space for more updates as we roll out more features to accelerate financial product innovation. Let us know about your innovation below and connect with one of us to partner on your next solution.