Building a fintech company can be like setting off on a mythic hero’s quest: the path is arduous and filled with danger before you reach the final goal.

The good news is you don’t have to make your journey to fintech success alone. In fact, you don’t even have to take the local [train]; we’ve got your e-ticket on the express. And today we’re going to lead you on that journey and show you what Productfy has learned in carving our own path.

Trust us, it’s a hard road to travel. Because in most cases, you’re paving new ground. And that creates challenges when you’re going to the bank as an innovator. Banks are by nature old-school, prescriptive institutions — it’s not their fault, though. It’s the world they live in, one dominated in complex and resource intensive issues of:

- Antiquated Fintech Stack — the backend system that runs basic banking operations and can be decades old. And so you must ask yourself, “am I an innovator or a laggard?”

- Navigating Compliance — federal oversight of banking creates a byzantine alphabet soup of rules and regulations, which must be carefully navigated and addressed.

- Complex Program Management — even the simplest banking product has multifaceted components that require time, resources, and deep institutional knowledge and attention.

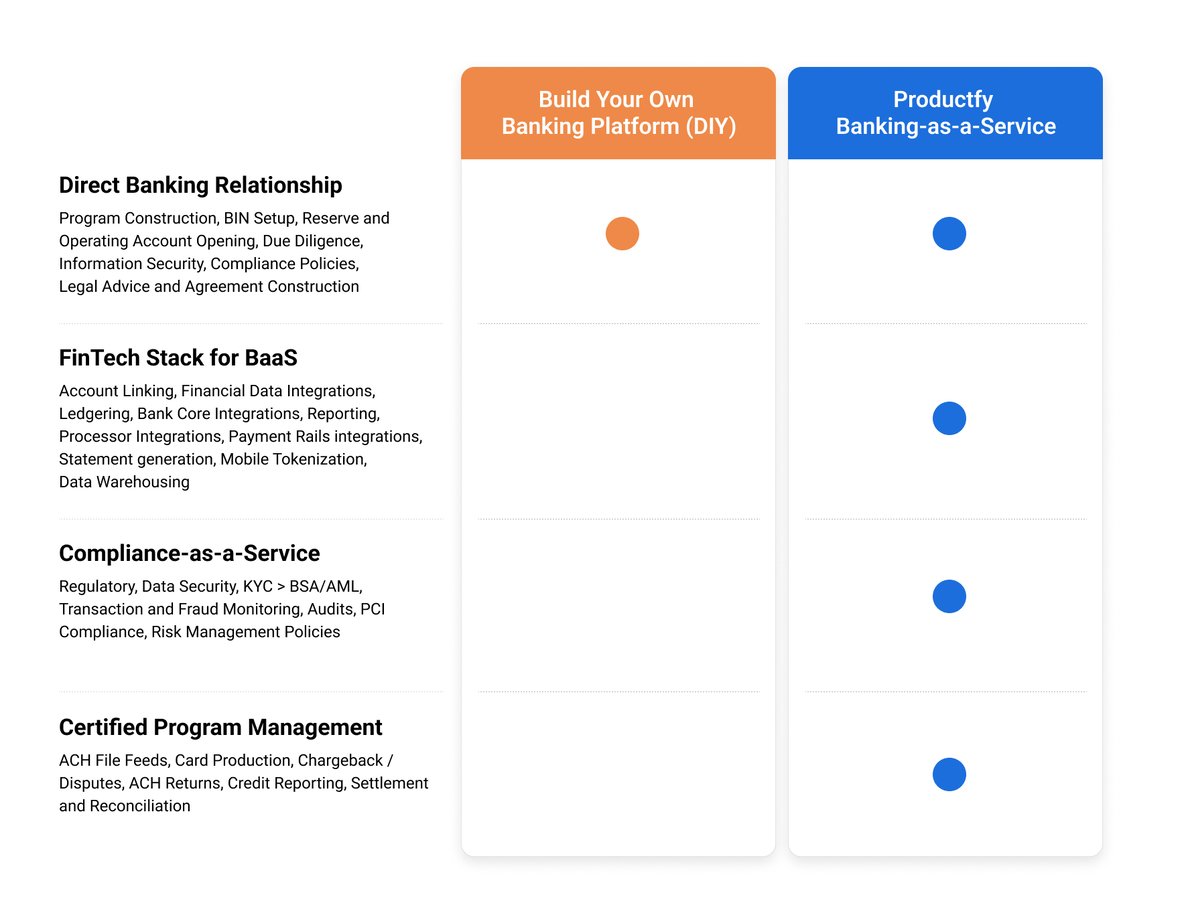

All three of these hurdles prolong your time to market, in addition to burning precious working capital and human resources. The path to deploying your own fintech app will require you to go through complex banking due diligence, lengthy onboarding, and costly fee negotiations. And it’s not an exaggeration to say that this can potentially take more than a year to navigate in order to become ‘certified’ as a Program Manager. Here’s a chart that identifies the many issues that Productfy delivers and manages on your behalf versus the limited value that comes from working directly with a traditional banking partner:

You could do this all yourself.

Or, find a partner who can do the heavy-lifting for you quickly, efficiently, and compliantly.

As the future of embedded finance gets further and further away from the mainstream banking world, it’s become apparent that many traditional banks are struggling to adapt to this new reality. And fintech innovators who are disrupting the world generally don’t have the domain experience, ability, or resources to forge their own path.

That’s where Productfy Banking-as-a-Service (BaaS) comes in.

We have already established strong relationships with many different bank partners. Our mission is to empower innovative companies to launch a financial product in the fastest time and at the most cost-effective price. We’ve also assessed and verified the banking relationship on your behalf, and affirmed partners who have a deep understanding of fintech.

To move quickly and deploy a viable product, it's essential to have a banking partner who has a strong vision for embedded finance. A few other things to look for in a partner who:

- Understands a crawl, walk, run approach

- Wants to work with BaaS to qualify and ensure all sides properly reflect their business risks and incentives, relative to their roles and responsibilities

- Wants to leverage BaaS to ‘manage the pipeline’

- Understands and has a forward vision for evolving their own tech stack to plug into BaaS

- Understands how BaaS compliance-as-a-service and Bank compliance will partner

- Has a core C-level sponsor on board

- Will not onboard more fintechs than they can handle

- Isn’t undergoing any material M&A initiatives that could change their commitment

It’s a long list, and while fintech is growing at a rapid clip, it can still be a challenge to find a bank who meets all these criteria – and odds are it may not be the one on the corner, which means establishing a relationship with an entity miles (and often several time zones) away.

It helps greatly if you have your house in order, and can articulate a go-to-market strategy in phases that include proper scope and scale factors commensurate with resources and access to capital, have in-house product or technical leaders, OR an in-house brand ambassador who understands the marketability of private label financial experiences.

The Productfy BaaS model is best suited for:

- Innovators who lack the resources to invest in or DIY build a banking stack from scratch, now or in the future.

- Those who seek a strong partner to deliver and embed financial products and services so you can focus on delivering your core value and solution differentiators to customers.

- Companies that want to quickly launch a Minimum Viable Product (MVP), iterate, and gain operating experience to further their business model with a trusted, strategic go-to-market partner.

- Fintechs seeking to build off a portion of the banking stack and integrate additional financial products or services in the future as they grow their users.

This is the sweet spot for Productfy. You have an idea, but not the desire (nor the time/stamina) to forge your own banking stack. There are many different routes to success to building a better BaaS. What’s right for you depends on your unique situation, needs, long-term vision, and timetable.

Learn more about what Productfy offers to accelerate financial product innovation at www.productfy.io