2022 was the inevitable reckoning for “move fast and break things” in FinTech and there are some critical lessons learned as we head into 2023.

Risk On

In 2022, we went from Sponsor Banks, Program Managers, and FinTechs all focused on quickly scaling and generating transactions that took precedence over operating a safe and sound commercially viable financial program. Banks like Evolve - arguably one of the leading Sponsor Banks - partnered with as many different channel partners and FinTechs as possible. Many Banking-as-a-Service (BaaS) Program Managers competed for the long tail of addressable pipeline with term sheets that drove negative margins and seemingly ignored the real cost of operations and compliance. FinTechs themselves offered sign-up bonuses and other incentives to acquire and support users which resulted in CACs being multiples of LTVs.

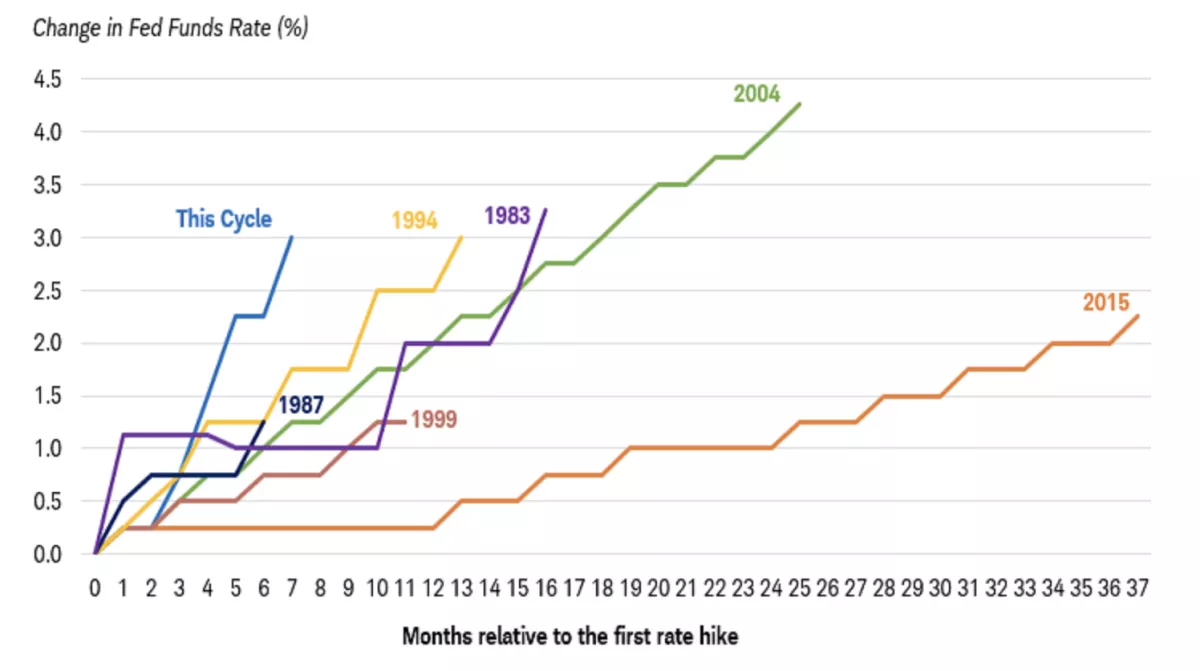

The Fed

With the Fed balance sheet contracting this year, capital markets have started to seize up. The Fed Funds Rate is increasing at the fastest rate in decades; this ‘end of cycle’ phase is forcing the market to go through some painful adjustments.

Source: Charles Schwab

Sequoia’s famous letter to founders earlier this year was a call to action to refocus on what matters. Growth at all costs means nothing without a path to positive margins and profitability faster. What this means for means for middleware companies like Productfy working with both Banks and Non-Bank Organizations is to take an even closer look at who we partner with on both sides of this ecosystem to align risk profiles, incentives, and commercial outcomes.

Not all organizations were so quick to adjust, however, and the ones that failed to adjust or were stuck with clients that could not raise additional capital have created havoc for Sponsor Banks and undue risk to the financial ecosystem.

The Blow Ups

FTX definitely wasn’t the first blow up of the year, but it’s the one that really epitomizes the Icarus moment of our times because too many organizations were playing too fast and loose with internal controls. We wrote an earlier piece on some of the underlying aspects of this market that are hitting all of us in the FinTech space.

The crypto blow up may finally be what gets the entire FinTech ecosystem into a better place with regulators cracking down on bad actors and organizations that flout reasonable internal controls. What we are witnessing now is a swing back towards a paradigm where compliance and rules actually matter again - a paradigm antithetical to those indoctrinated with “move fast and break things”.

Risk Off

Sponsor Banks are being forced to be more circumspect, which means the supply side of the market now dominates and controls innovation.

What this means for FinTechs: An innovative financial product that could have passed muster six months ago may not pass muster today. Regulators are increasing their scrutiny of Sponsor Banks which in turn are increasing scrutiny of their Partners. In some cases they are either terminating their relationships with Partners and FinTechs or pausing programs and mandating remediation where there are gross violations.

Looking Ahead to 2023

Any of you who have spoken to anyone on our team in the past two years knows we’ve been working to bring Embedded Finance to the mass majority.

Our product thesis for Embedded Finance has stayed consistent: build world-class financial solutions that Brands and other Non-Bank Organizations can license, and power it with Productfy’s compliance and program management-as-a-service.

World Class DevX

To this end, we continue to build and release APIs that enable FinTech builders to craft their financial customer journey. We remain highly vigilant of who gets access to our APIs and endpoints and our qualification criteria have evolved with the risk sentiment of our Sponsor Bank Partners.

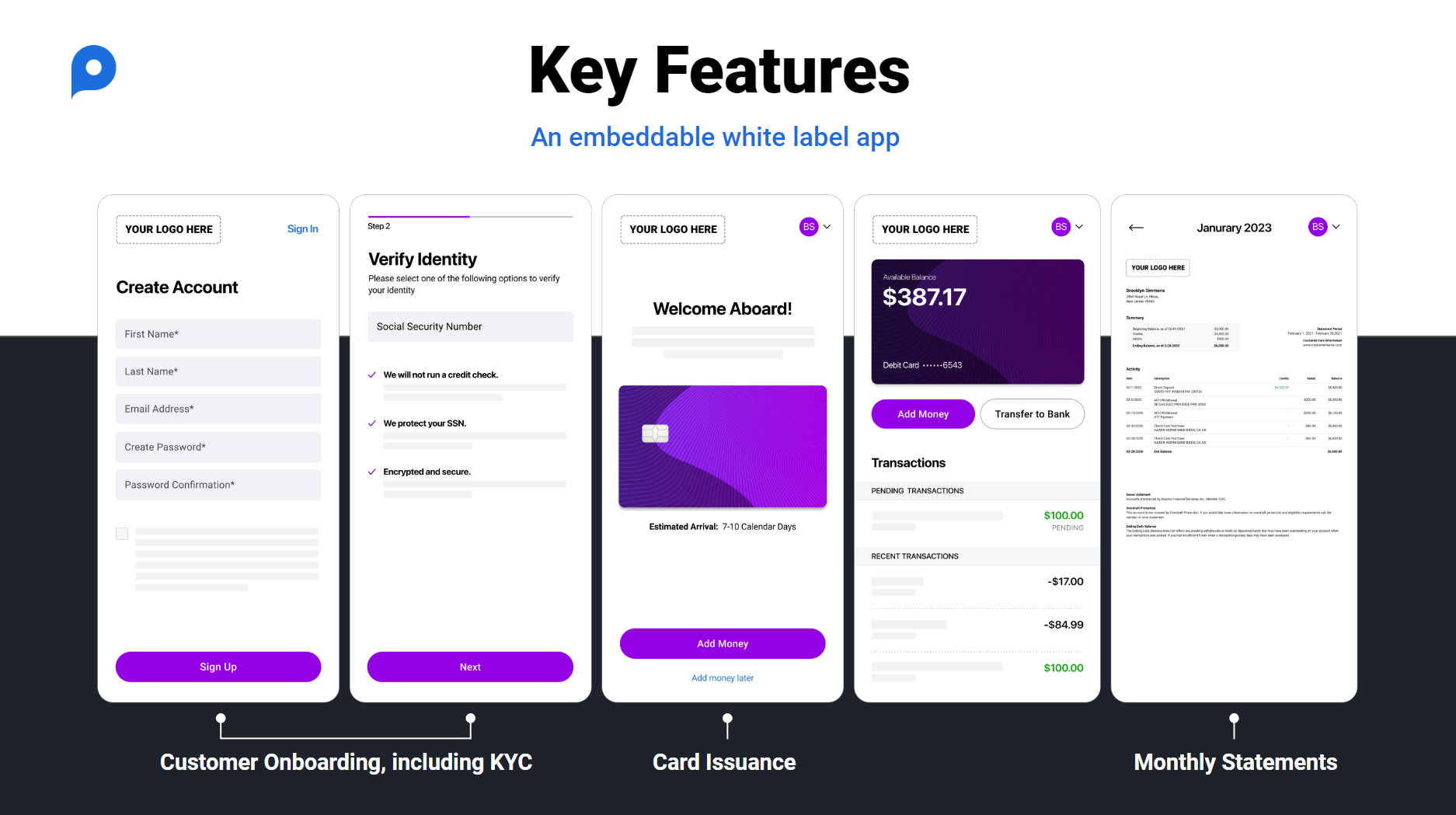

White-Label Marketing Partners

We’ve aligned our compliance, product, servicing, and commercial efforts around our white-label card solutions (code named Latinum) with the goal of enabling any organization to offer financial solutions without engineering, compliance, or program expertise - at scale - in as little as a few weeks.

We’re excited to announce our initial cohort of Marketing Program Partners launched in Q4 of 2022. These organizations are experts in two critical aspects:

- Marketing / User Acquisition

- Brand and Customer Relationship Ownership

This partnership approach enables Productfy to leverage our own strengths as program manager, infrastructure builders, operators, and compliance experts. Once a Bank Partner approves a Marketing Partner, we can launch these clients quickly in as little as a few days - in one case it was under three business days.

Here are the reasons we’re bullish on full stack white label financial products as a market opportunity:

- Standardized programs, disclosures, and interfaces – which means 1-2 orders of magnitude faster to launch clients (i.e. days, not months).

- Operational, compliance, and client servicing costs are an order of magnitude less because we’re not developing bespoke programs each time.

- Focus on competitive strengths: Productfy as FinTech, Compliance, and Product Manager | Our Partners as Marketing and User Acquisition Specialists or Product Specialists in another vertical (Real Estate, Travel, Insurance, SMB SaaS, Non-Profits).

- White labeling aligns risk management, clear roles and responsibilities, expediency to market, and commercial viability into a scalable and fast GTM for all parties.

Doubling Down on our Core Mission

Being an operator in the FinTech space has never been easy, but we knew compliance was always going to be a centerpiece of our GTM from the early days. We started Productfy with the belief...

We think this belief drives us to align incentives across the entire value chain from Sponsor Bank Partners to End Users, which is the root of a sustainable business; doing the right thing is also the right thing for our business.

And this is how we’re changing the way financial products are built…for good!

Watch this space for more updates as we roll out more features to accelerate financial product innovation. As always, connect with us below to learn more about how innovative card programs and scalable features can power your financial product or fintech program.