July has been an exciting month for us both inside and outside of work. Billionaires launching into space, COVID restrictions easing and Productfy making huge product launches stand out as the big events of the month. Here’s a summary of what we launched in July.

Debit Card Programs are Live!

After many months of tech buildout and coordination amongst banking partners, card networks, processors, and compliance officers I’m proud to say our debit card program is live. Productfy has taken on all the heavy lifting to make it very easy for companies to launch live debit card programs on our platform quickly. If you’re interested in partnering on card programs please let us know. Below are some key features with this initial launch.

- Issue Card API

This API allows you to open virtual accounts and order debit cards with one simple API call.

- Physical and Virtual Cards

For physical cards we support custom card design and card carrier options. Additionally we can make virtual cards available in real-time to get cardholders using their card quickly. Our UI widget allows fintech apps to easily display virtual card credentials in a secure way.

- Transaction Management

We support a full suite of simulation APIs that allow you to test all the different kinds of card transactions that can happen and build your app accordingly. All debit card transactions (even declined transactions) generate webhooks to keep you informed on what’s going on. Additionally our APIs allow you to retrieve a PaymentCard data object that contains transaction detail like merchant category codes, merchant IDs, and the cardholders running balance at the time of the transaction.

- Compliance-as-a-Service

Of course, we can’t forget about compliance. Productfy’s compliance team is ready to streamline your debit card setup and provide clear guidelines around things like Terms and Conditions, marketing, and UI requirements.

Money Movement

Building on our ACH money movement solution, we have a number of enhancements to make this easier to launch and support for developers and business managers.

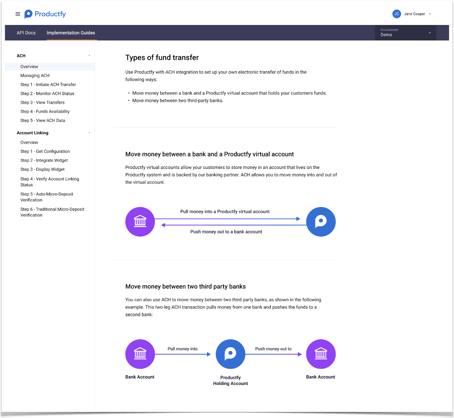

- Implementation Guides

Developer experience is paramount for Productfy and to that end we have published step-by-step walkthroughs of how to integrate to our ACH and Account Linking features online. This clearly shows you how to integrate your app to our services to launch these features. Access the guides here.

- ACH Webhooks

Presenting the right user experience to customers can be tricky with ACH since all of this is built on top of the archaic batch-based ACH network in the United States. The hardest part for the customer is simply knowing where their money is when a transfer is in process. We now have webhooks available that will inform you of the different states of ACH processing (including returns) so that you can build a UI and UX that keep customers informed of where their money is.

KYC

Know-Your-Customer regulations require identity verification of customers who are opening accounts and transacting. In the digital world, it becomes even more difficult to do this in a sound way while maintaining a streamlined experience. We have iterated on our base KYC offering to make this even easier for clients.

- Name/Address handling

We now support edge cases where customers have changed their last names or addresses for valid reasons.

- DMV Verification API

In cases where customers don’t pass the initial identify validation check, they can now enter driver’s license details that will get validated against Department of Motor Vehicles databases in supporting states to complete their identity verification.

Watch this space for more updates as we roll out more features to accelerate financial product innovation. Let us know about your innovation below and connect with one of us to partner on your next solution.