Business

Debit Cards

Made Simple

Easily spend, pay, and manage

your finances and cash flow

your finances and cash flow

Deposits with Acme Bank are FDIC insured up to $250,000

%20(1).png?width=430&height=314&name=Group%209423%20(1)%20(1).png)

Key Features & Benefits

Enjoy no frills, no fee banking

- 1.5% Cash Back - Great card benefits and rewards on all corporate purchases

- Mobile Payments - Enroll your card information in Apple Pay®, Google Pay® or Samsung Pay® to be able to pay with your phone in stores.

- A Modern Digital Experience - Paperless Onboarding, Digital Statements and Virtual Cards

- Quickbooks Integration

- No Annual Fees

How It Works

1Paperless Enrollment

Get approved in minutes with our paperless onboarding

How It Works

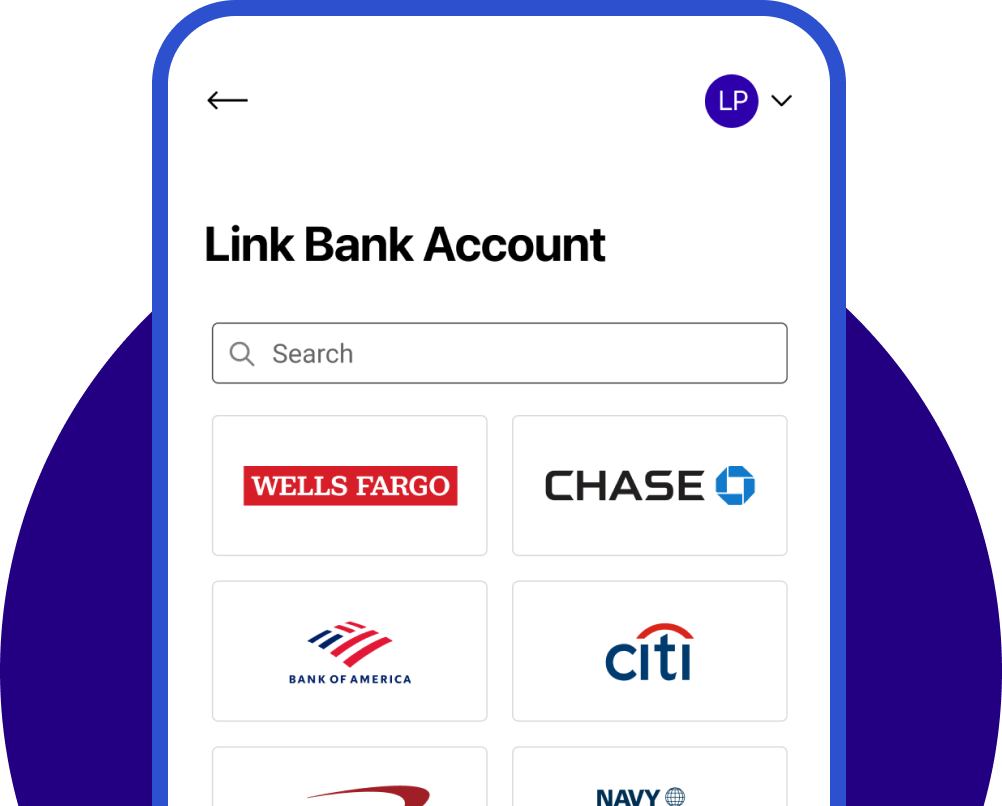

2Link Your Bank Account

Connect your external account in minutes.

How It Works

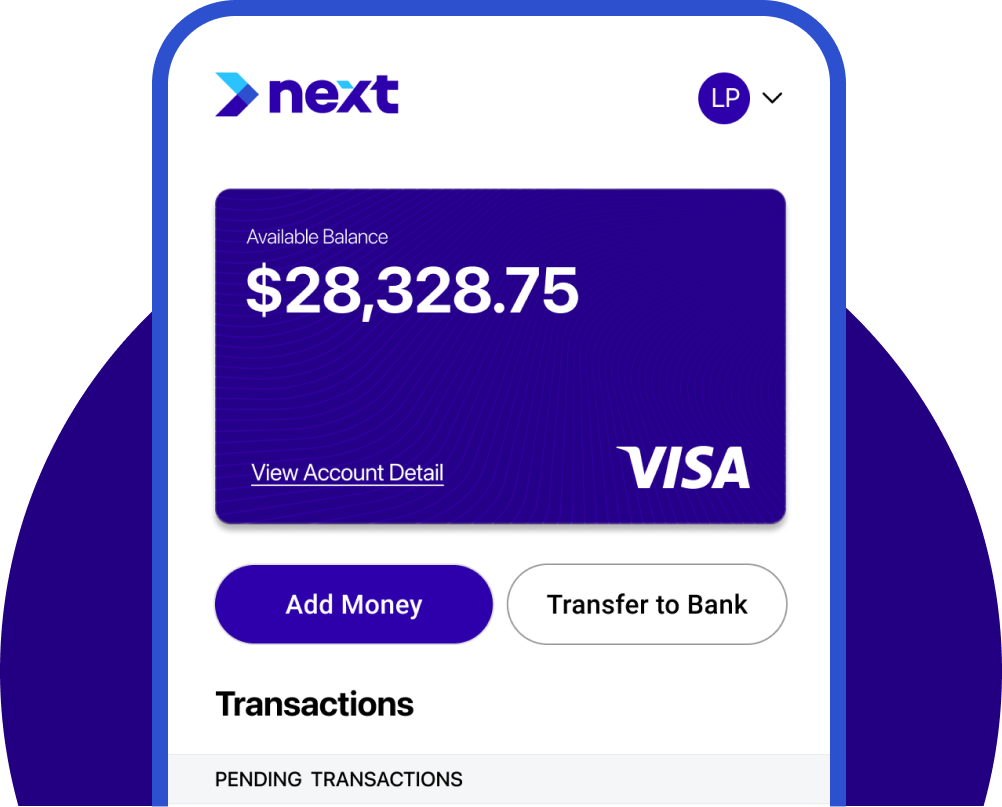

3Manage Your Cash Flow

Leverage our suite of products and services to easily pay and get paid.

.png?width=1002&height=806&name=slide_one%20(1).png)

Frequently Asked Questions

What’s the daily spend limit?

$100,000

Is my account insured?

Yes, your account is fully FDIC insured up to $250,000

What are the daily deposit and withdrawal limits?

$100,000

Do I need to be a U.S. registered beneficial owner?

Your controller must be based in the United States. Beneficial owners may be located outside the U.S. - specific country limitations may apply.

Is Productfy a bank?

Productfy is a financial technology company that partners with Acme Bank on the commercial card program and acts as program manager.